Convenience banking is one of the most important features of modern society. As most of the financial activities have gone online let’s ensure that our online banking transactions are safe.

One of how this can be achieved is through the use of a Virtual Private Network commonly referred to as a VPN. Here in this article,

I will explain to you how one should go about using a VPN for online banking to protect their online banking details and why the application of VPN has become relevant in contemporary society.

Understanding VPN and Why Do You Need It?

A VPN or Virtual Private Network, creates a secure connection between your device and the internet.

This means that all the data you send and receive is encrypted, making it difficult for hackers to intercept.

When you use a VPN, your real IP address is hidden, and you can appear to be browsing from a different location.

This is particularly useful for online banking, as it helps protect your sensitive information from prying eyes. To ensure your privacy, it’s always a good idea to check IP address changes regularly.

How to use a VPN for online banking security is straightforward and can greatly enhance your online safety.

Why Use a VPN For Online Banking Security?

A VPN cloaks the internet connection and encapsulates the traffic, safeguarding it from malicious attacks from hackers in addition to protecting the owner’s IP address from neighbors or vandals.

When you establish a connection to the VPN server, the data that you send out is encrypted and can hardly be read by any other individual apart from the intended receiver.

This is even more so when connecting to the internet through a Wireless Fidelity (Wi-Fi) that is most often openly available and thus easily hackable.

Using a VPN, one might ask, is VPN safe for online banking? Indeed, it provides an additional layer of security, especially when logging into bank accounts.

Besides encryption, this is useful in situations where one is logging into their bank account while in a foreign country, for instance, as it enables the bank to avoid detecting that the account has been accessed from a foreign country.

Including the benefits of VPN for banking, you can ensure additional security for your financial transactions.

Choosing the Right VPN

Many securito questions must be answered when researching a VPN protection provider; therefore the choice of a suitable provider should not be taken lightly. In 2024, some of the best VPNs for online banking include:

- NordVPN: That is one of the serviceThisown for securit y and speed.

- Surfsecurity option that is relatively cheaper but comes with a lot of safety features.

- Norton Secure VPN: It is regarded as a reliable source with great security in an online transaction process.

- IPVanish: Strong and can be used in banking services especiallytinternet banking services.

- PrivateVPN: An economic option with suitable security elements for bringing in a client base.

While choosing a VPN, check for features like strong encryption, a no-logs policy (which means they don’t keep records of your online activity), and good customer support. For added security, consider using the best VPN for banking to ensure your financial data remains protected.

How to use A VPN for banking online

A VPN for online banking can therefore be regarded as a very basic yet efficient method of boosting security. Here is how you ought to make the most of a VPN when banking online, as explained step by step for clear comprehension:

- Select a VPN Service Provider Company

The first step in how to use VPN for banking securely online is choosing the best VPN software company. Security should be given high preference while choosing the providers. Some top options in 2024 include:

- NordVPN: Known for its strong security features and fast connection speeds.

- Surf Shark: Offers affordable plans with excellent privacy protections.

- IPVanish: Provides reliable service with a focus on security.

While choosing a VPN, check for features like strong encryption, a no-logs policy (which means they don’t keep records of your online activity), and good customer support to ensure you have the best VPN for banking.

- Install the VPN App

The next step when selecting a VPN provider to use, is to download the VPN application or client onto your desired device. This could be your computer, smartphone or attabletD

Download the App: In most cases, the official app is available on the VPN provider’s webpage or on the relevant application store of your device.

- Follow Installation Instructions: Any VPN service that you wilose to use will help you through the installation process. Always grant any permission that the app requires in tork to the optimum level.

BasJustving the app installed is important if one wants to connect to the VPN and make sure that their online banking processes are not vulnerable.

- This is done by linking the particular VPN server.

Lastly, after installing the VPN on router or app, yorequirere required access to a VPN server. Here’s how to do it:

- Open the VPN App: Tap on the application to start it on your device.

- Connect: Go on and click the connect button. Transaction facilities may take a few seconds to build up the connection. It will take a few moments to connect you and we will notify you when this has occurred.

- Select a Server: In this step ensure that you select a server that is based in your home country. This is important because it takes the appearance of accessing your bank from a familiar location, thus avoiding the setting off of security alarms.

Thus, using a VPN service, you proxy through a server that encrypts your Internet connection, and your original IP address is not visible, which increases the security of your banking operations.

Additionally, understanding the benefits of VPN for banking ensures that your financial activities are safeguarded against potential threats.

- Access Your Online Banking

You can now unlock your laptop/PC and log into your online banking account since you are connected to the VPN. Here’s how to do it:

- Open Your Bank’s Website or App: Interact with your browser or banking application in the same way that you would when conducting activities in the course of your day.

- Log In: Before you use the services, you are required to sign into your account using your account details; that is, the username and your password.

- Conduct Transactions: You can execute a transaction, and even balance check or personal monetary operations easily and safely now.

Another advantage of using the VPN is that while you are connected, your data is encrypted and passed through a tunnel thus it is much harder for hackers to gain access to it.

- Lightning-fast speeds to browse without lag

- Servers in 105+ countries around the globe

- Military-grade security to stay safe online

- Try it risk-free with its money-back guarantee

- Native apps for all major devices

What Will Happen If You Do Not Connect To A VPN

If you do not connect to a VPN while conducting online banking, several risks and consequences can arise. Here are some key points detailing what can happen:

Increased Risk of Data Theft

When you are not connected through a VPN, your internet connection is not secure whatsoever.

This means that any data you enter or receive both on your device and through the internet through any of your activities such as banking, passwords, and others are easily accessed by hackers.

But even in the case of paid connections, the threat is blatant, especially in Places that offer public Wi-Fi such as cafes and airports.

Thieves can observe these networks since the data sent along them is often unencrypted, threatening your money details.

As for risks to users, you have to understand that each time you open a website containing a webcam, the person on the other end can see your IP address.

Without a VPN, the website and online services, including your bank realize your actual IP address beyond the VPN tunnel. This can lead to various issues:

- Geolocation Tracking: Your bank most probably sees your IP address to trace your location. If you log in from a different location, for example, from a cyber cafe most of the accounts will alert the management or even block you from accessing the account.

- Targeted Attacks: This a technique that hackers will use to attack an individual, and since they already have your IP address, they will conduct other scams, which may include identity theft.

Vulnerability to Cyber Attacks

Without the protection of a VPN, you are more susceptible to various cyber threats, including:

- Man-in-the-Middle Attacks: In this kind of attack, a hacker gets in the middle of your interactions or communications with your bank. They can corrupt the data being transmitted or received, thus causing undesirable and unlawful transactions.

- Malware Infections: This is a pretty scary thought; in essence, one doesn’t necessarily need to download a malicious program, as by connecting to public Wi-Fi, one may download a whole lot of malware that may get to one’s bank account number.

Lack of Privacy

Connecting to a VPN assists to protect your identity while you are online. Without it, your Internet Service Provider (ISP) will be able to monitor your bank activities on the internet among other things.

This data can be shared with other entities or for advertisement purposes hence posing a threat to your privacy.

Therefore, failing to connect to a VPN while transacting via the internet at the banking sector puts one at risk of being subjected to fraud activities such as theft of data and identity and exposure to surveillance.

In order to protect your personal data and account details the use of a VPN should be incorporated to your activities especially when using public Wi-Fi to access your banking account.

This way, it is possible to prevent abuse of your personal data and keep your finances in order with minimal stress.

Recent Life Scenarios For Online Banking Security

Here are some real-life scenarios where using a VPN can enhance online banking security:

Scenario 1: Traveling Abroad

Let us describe Sarah, she is a businesswoman currently on a business trip to another country.

She has to clear her balance and also make a transfer and hence she has to log into her account. But she has some apprehensions sharing her bank’s website on any new unfamiliar public Wi-Fi network.

Before going online, for instance in her home country, to engage in online banking, Sarah has to connect to a VPN server first.

This masks her Internet traffic and makes the outside world view her connection as being from her home country.

This way, she keeps her bank from getting suspicious of such transactions and also avoids different hackers that thrive in the public networks accessing her valuable financial details.

Scenario 2: Working Remotely

John is employed in an organization that has adopted work from home provisions for its workers.

He frequently connects to the organisation’s internal networks and client’s information through the company’s virtual private network.

As for John – the employed VPN from the company guarantees the encryption of his internet traffic and hiding the real IP address.

This guarantees that all information he employs or relays involve in his work-from-home assignments are safe and shielded from a third party’s reach.

Scenario 3 You are at a coffee shop and you are connected to the public Wi-Fi.

It is evening, Sarah is at the airport to catch her flight, and she therefore decides to check her balance on her account through an unsecured Wi-Fi. Nevertheless, she features the dangers of such a public network in connecting to the internet for banking services and realizes the importance to protect online privacy on public Wi-Fi.

Before browsing her banking website, Sarah is linked to a reliable VPN service on her mobile phone.

It disguises her IP address and encrypts her data so that hackers will have a tough time capturing her login information or the her financial details while in the unsecure public Wi-Fi.

Scenario 4: Using the accounts when you are on the move

This is an indication that John is out of the country probably enjoying his vacation. He has to find his credit card and see how much money he has left and when was the last time he recharged it.

He is worried such requests might attract notices from his bank’s security team if he uses a different IP address.

Before entering his credit card account, John links himself to a VPN server that is in his home country. This is advantageous in that it prevents any problem from arising with him bank since it seem as though he is log in from his domicile.

It also helps encrypt his data which becomes very helpful when he is engaged in financial transactions in foreign countries.

In each of these real-life scenarios, using a VPN has proven to be an effective way to enhance online banking security.

By encrypting internet traffic and masking IP addresses, VPNs protect sensitive financial information from potential hackers and help prevent security issues when accessing accounts from unfamiliar locations or networks.

Uninterrupted, high-speed browsing, zero logs so your online activity is always private.

Over 7000 people checked out NordVPN in the last month

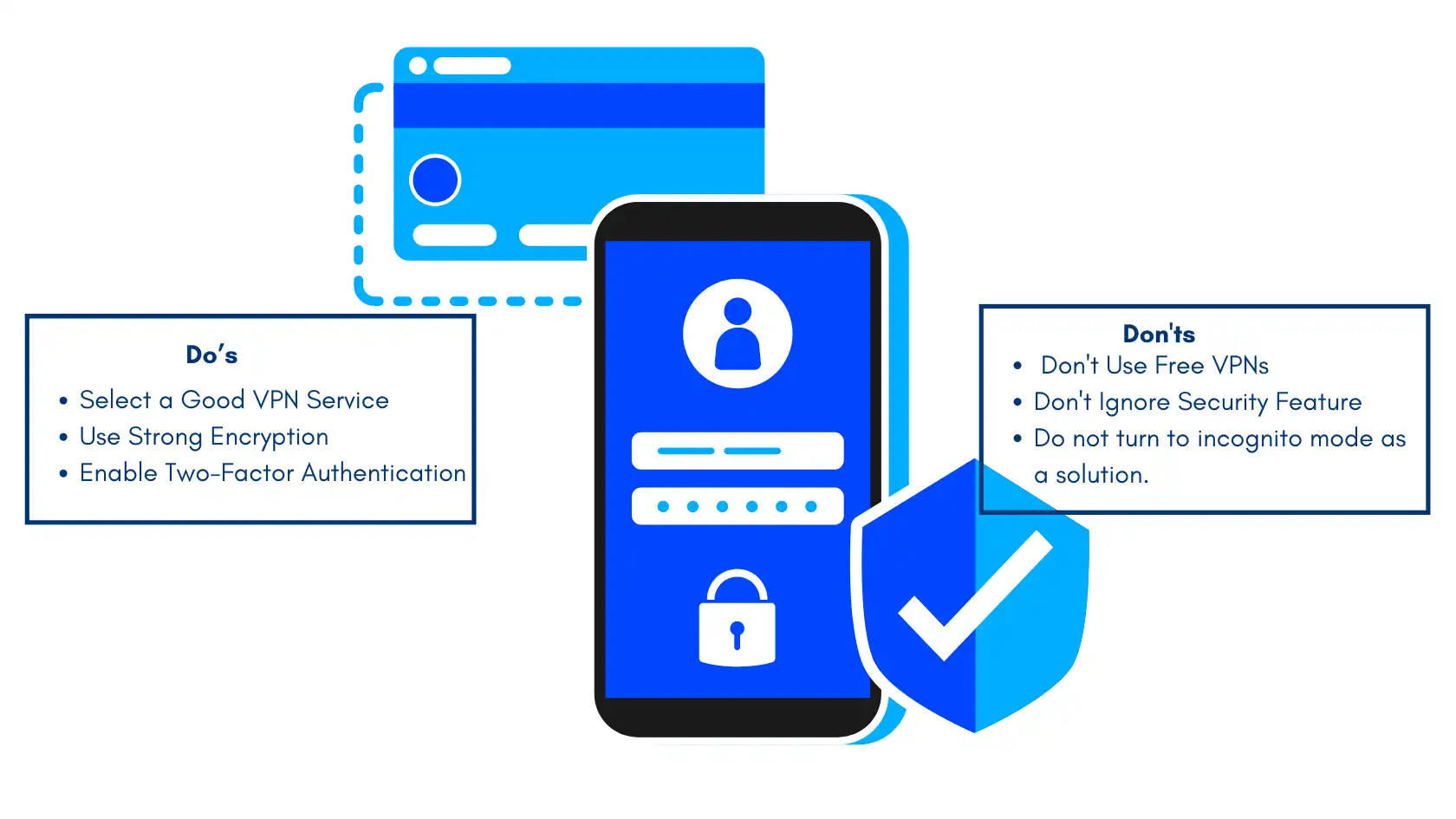

Do’s and Don’ts For Online Banking Security

Do's

- Do Select a Good VPN Service

- Yes Connect to a Server in Your Home Country

- Do Use Strong Encryption

- Do Enable Two-Factor Authentication

- Do Keep Your VPN App Updated

- Should enable a kill-switch feature

- Inform your bank about your travel plans.

Don'ts

- Don't Use Free VPNs

- Do Not Use the Banking Apps on Open and Insecure Connections

- Frequent switching of the VPN locations should not be done

- Don't Ignore Security Features

- Never follow links from such sites, as they are believed to contain corrupt codes that can affect the user’s operations.

- Do not turn to incognito mode as a solution.

- VPN credentials are extremely important and should not be shared with anyone.

Applying all the specified do’s and don’ts, you will be able to protect your business and personal finances while utilizing the VPN for safe online banking.

Troubleshooting Common Issues

There can be times when you will not be able to access your bank as easily while on a VPN. Here’s what to do:

- Contact Your Bank’s Support: In the event of any challenges contact your bank for support.

- Try a Different VPN Server: Sometimes, changing servers is a solution to the access problem.

- Disable the VPN Temporarily: If other solutions do not work, it can be turned off when using the banking app; the VPN connection can be restored later.

Recent News On Online Banking Security

Hackers Target Online Banking Accounts

According to tally, it is said that in 2024 the criminal activities on cyberspace is on rise and the new thing that has come into operation is the account of online banking.

They will send people emails that mimic trustworthy ones accompanied by viruses that will grab people’s logins and drain their money

The new banking trojan called Sphinx is already available markets with the price tag of $500 in black markets.

It can blind drop and hence can be useful for fraudsters to gain access to account details and perform malicious transactions.

Banks Blamed for Poor Security

My recent study already highlighted a recent report prepared by the British consumer group Which? identified severe vulnerabilities in the mobile applications of several of the United Kingdom’s banks.

In a comparison of the fifteen firms, TSB and the Co-op Bank managed to come out with the worst mobile apps security. TSB app retains the login information unsafely and the Co-op app has no feature of second factor verification.

These are permitting user to use short password, user id not logging out when idle and providing hard coded different messages for valid and invalid user ids to facilitate hacking valid id’s.

Forced actions During forced actions payable in dollars, the Bank will require detailed information about the type, amount, and frequency of transactions, the specific Web sites, and the…

As a measure of personal security, one should always apply a VPN before logging in to an online banking account. A VPN protects your online connection by encrypting the traffic that gets passed over the internet and obscures your IP address, this makes it very difficult for hackers to get in the middle of your connection.

For security, the VPN should include high-end encryption, safe protocols, alogs nothing policy, and the additional aspects such as kill switch, as well as WI-Fi protection.

Other Tips:

- They should not be easy to guess and it is advisable to have a different password for different accounts.

- Provide option to do two-factor authentication when possible

- Phishing emails and unprotected public Wi-Fis are other things that one should possess utmost caution.

- Ensure the devices and the software being used is latest version.

- It is recommended that people frequently check their accounts for any irregularities or any signs of hacking.

This way, following the above mentioned tips and using a proper VPN, the aforementioned risks associated with online banking fraud shall be minimized. Be alert and tend to your accounts safety.

FAQs

Will a VPN protect my online banking?

Yes, a VPN (Virtual Private Network) can protect your online banking. By encrypting your internet connection, a VPN makes sure that your data is transmitted securely which makes it very difficult for cybercriminals to intercept your information. It also hides your IP address by adding an another layer of privacy for you.

Which VPN is best for online banking?

When you are choosing a VPN for your online banking, you should look for one with strong security features, a no-logs policy and a reliable performance. NordVPN, IPVanish and SurfShark are often recommended for their powerful security protocols, ease of use and excellent customer support. Which makes them very ideal choices for secure online banking.

What methods are there to obtain a VPN?

Connect to a reliable VPN service and install their application for better and smooth streaming.

Can I access my online bank account from abroad?

Yes, you can access your online bank account from abroad using a VPN. A VPN allows you to connect to a server in your home country which makes it appear as you are accessing the internet from your own home country. This can also help to bypass geographical restrictions and avoid possible security flags from your bank when your are logging in from a foreign location.

Conclusion

Thus, understanding how to utilize a VPN for protection while banking online is crucial in the contemporary world.

In the context of rising threats of cybercrime, the effectiveness of using a VPN can prevent your valuable financial data from being a target and provide you comfort when doing online banking.

The above article has provided you with certain steps that you can take as well as certain general measures that, if observed, will enable you to start banking online without worrying about the possibility of becoming a victim of cybercrime.

Remember, your financial safety is in your hands, and using a VPN is one of the best ways to safeguard your online banking activities. So, take action now and make online banking a secure experience!